How Can You Tell if It Is Bpi or Bpi Family

The Bank of the Philippine Islands (BPI) is one of the more known banks here in our country. Servicing over a 1000000 people, BPI truly is a bank you can look upward to. In addition to their banking services, BPI as well offers unlike types of loans. In this commodity however, we will be discussing the BPI Auto Loan. What you're able to get, what you need for application, and of form farther information most information technology.

Read: Applying for a Personal Loan with BPI Online

What vehicles can I purchase with the BPI Auto Loan?

Not merely that, we'll also tell you how much down payment it would need and the terms. In applying for the BPI Family Auto Loan, you can purchase:

- Brand new vehicles with a downpayment of xx%; Term would be 1-half dozen years;

- Second hand unit with a downpayment of 30%; Term would be 1-5 years; and

- Make new trucks with a downpayment of thirty%; Term would be 1-3 years.

Who are eligible for a BPI Auto Loan?

Filipinos who are between 21 to 65 years old with a total monthly family income of at least Php 40, 000.00. Foreigners who are married to Filipinos are too eligible for the BPI Family Automobile Loan.

What would be the requirements?

The pre-processing requirements in applying for a BPI Motorcar Loan would be:

- Duly accomplished Application Form

- 2 valid IDs

- If married, both spouses to sign the application form

- If with co-borrower or co-mortgagor, a split application form is needed

Income Documents (If locally employed (working within the Philippines)

- Certificate of Employment (CoE) indicating bacon, position and length of service

- Latest Income Taxation Return (ITR)

If Cocky-Employed

- G.I.S. (General Information Sheet)

- DTI Registration

- Articles of Incorporation and By-Laws with SEC Registration Document

- Audited Fiscal Statements for the last ii years

- Income Tax Return due west/ audited fiscal statements for the last ii yrs

- List of Trade References (at least 3 names with phone nos. of major suppliers/customers)

- Bank Statements for the past 6 months

Income Documents For Expat Pinoy (Overseas Filipino Worker)

- Monthly remittance proof

- Contract/Document of Employment (CoE)

- Crew Contract and Go out Laissez passer validated past POEA (Seaman)

- Notarized or authenticated Special Power of Attorney (BPI FSB Format)

- Duly achieved Auto Loan Application form required by POEA

Read: How To Apply For UnionBank Motorcar Loan

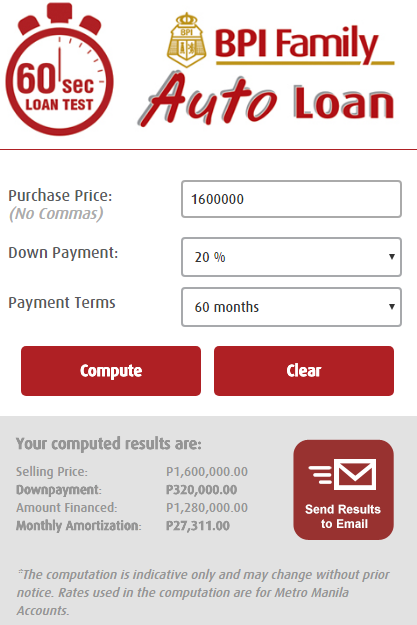

BPI Loan Reckoner

Just like whatsoever other bank car loan application, the BPI Family Auto Loan has a calculator as well. By using this, yous would exist able to choose the financing program that would all-time suit your needs and of course your capacity to pay. Moreover, yous'll exist able to check if you're eligible for the program firsthand.

In this tool, you will exist asked to make full out:

- The purchase price of the car;

- Downwardly payment; and

- The terms of the payment (length of the contract)

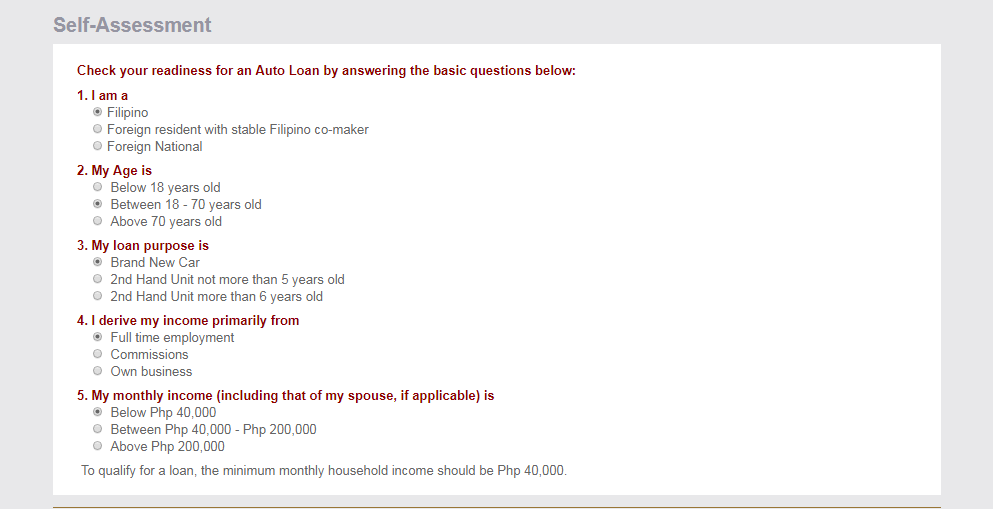

Cocky assessment tool

The self assessment tool can exist your guide on choosing which financial path to accept in applying for a BPI Car Loan. In addition, using this would besides permit you to run into whether or not you're eligible for the program.

In the example above, it can conspicuously be seen that you need a minimum of Php40, 000.00 monthly income to qualify for the BPI Auto Loan. If you lot think this is a bad thing, recall twice. There are banks who require as much as Php50, 000.00 in monthly household income to qualify for a auto loan.

Read: OFW Automobile Loan For Saudi Arabia And Hong Kong Workers

How can I pay off this BPI Family Machine Loan?

BPI offers flexible ways on how you can pay for information technology monthly. You are not tied up to the Motorcar Debit Arrangement (ADA) method. In fact, the following can exist used in paying off your BPI Motorcar Loan:

- Auto Debit Organization (ADA) – payment will be automatically deducted from your deposit or settlement account

- Over the Counter (OTC)

- Mobile Banking – Through BPI Mobile text facility

- Phone Cyberbanking – Phone 89-100 and pay through the system or with a representative; and

- Online banking – log on to the BPI online banking website

Paying over the counter (OTC)

Over the counter payments for a car loan is slightly unusual. Why? Considering companies like to secure the payments readily. This is where BPI's machine loan has an reward at. Although you lot won't exist saved from the hassle of visiting the bank every now and then, y'all have to option to pay it yourself. Furthermore, you won't be forced to pay automatically.

Payments tin can be done at whatever BPI or BPI Family Savings Bank co-operative by filling out the deposit slip using your Loan Business relationship Number as reference and SBA'due south as follows:

- Fill in the Special Banking Organisation (SBA) number in the account number boxes: (For BPI branches- (SBA#) 0011140386 ;For BPI Family Savings Bank branches – (SBA#) 7993000013)

- Write AUTO LOAN in the Account name/Merchant's name infinite

- Put in your Loan Account Number in the Reference no. space

- Fill up in client's total proper noun in the planholder's proper name space

I'm interested, what exercise I demand to fix for initial submission?

First thing is that you need to secure a duly accomplished BPI Auto Loan application form. If you're an employee, submit information technology together with your Document of Employment (CoE) with salary and ITR. If you're, self-employed, partnerships or corporations, we would demand copies of your business registration papers, articles of incorporation (if applicable), ITR and latest fiscal statements, a listing of trade references including addresses and contact numbers.

What are you waiting for? This may be the chance in getting your dream car for y'all and your family. Contact BPI now at their hotline: 89-100 or email them at[email protected]

Source: https://www.efrennolasco.com/bpi-auto-loan/

0 Response to "How Can You Tell if It Is Bpi or Bpi Family"

Post a Comment